36+ can a retired person get a mortgage

Repayment period You might have less time to pay the mortgage back depending on. Lock Your Rate Today.

Proptech Switzerland Innovation Index 2021 By Proptech Switzerland Issuu

Web Mortgage qualification requirements for retirees.

. However some borrowers can. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Web For an asset depletion you would add up your financial assets and subtract the amount you would use for a down payment. Web Thanks to the Equal Credit Opportunity Act retirees cant be refused a mortgage as long as their credit debt-to-income ratio and factors required of anyone applying for a mortgage. Web If you are retired or a pensioner no matter your age from 55 to 99 you can get a mortgage and you have more mortgage options than someone under 55 years of age.

Apply Now With Quicken Loans. Web For a conventional mortgage loan lenders typically require a DTI of 36 to 45 of stable monthly income depending on credit score. Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You.

For Homeowners Age 61. Get A Free Information Kit. The qualifying criteria remain the.

ROIs and lifetime mortgages generally have a minimum age requirement of 55 with some lenders. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Comparisons Trusted by 55000000.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. If youre thinking of coming. For Homeowners Age 61.

Web If you dont receive monthly income from your retirement accounts you might find a lender who is willing to qualify you through asset depletion amortizing a. Web Yes you can get a mortgage as a retiree as long as you can show a lender that youre still earning income or that you have enough money saved for retirement. Ad An Easier To Qualify Reverse Mortgage Alternative.

Similar to getting a mortgage before retirement youll. Web For a conventional mortgage loan lenders typically require a DTI of 36 to 45 of stable monthly income depending on credit score. Were Americas Largest Mortgage Lender.

If youre retired you may have multiple streams of income that contribute to. Ad Compare the Best Reverse Mortgage Lenders. Though qualifying for a mortgage with retirement income comes with specific requirements.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. However some borrowers can. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. And retirees can use their retirement accounts to prove that they can afford a mortg Menu burger Close thin.

Web For the drawdown-in-retirement method you can put as little as 5 down. Web If were basing eligibility on age alone a 36-year-old and a 66-year old have the same chances of qualifying for a mortgage loan. Web Web Offering you a mortgage is riskier as you get older so to compensate lenders may impose maximum age limits or say you need to take a mortgage over a.

Ad 10 Best House Loan Lenders Compared Reviewed. You would then take 70 of the. Ad Compare Mortgage Options Calculate Payments.

Lock Your Mortgage Rate Today. Get Instantly Matched With Your Ideal Mortgage Lender. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Web The good news. Web The first step in deciding whether you can afford to buy a home is assessing your income. For the asset-depletion method plan on putting 30 down.

Shared Equity Is A Reverse Mortgage Alternative with Better Lenders Requirements. Assets Retirees often have significant assets but limited income so Fannie and Freddie have found ways to help. Web What are the age limits for retirement mortgages.

Web When applying for a mortgage as a retiree there are a few extra things to look out for. Web Mortgage approval largely depends on your income.

Retirement And Consumption In A Life Cycle Model Journal Of Labor Economics Vol 26 No 1

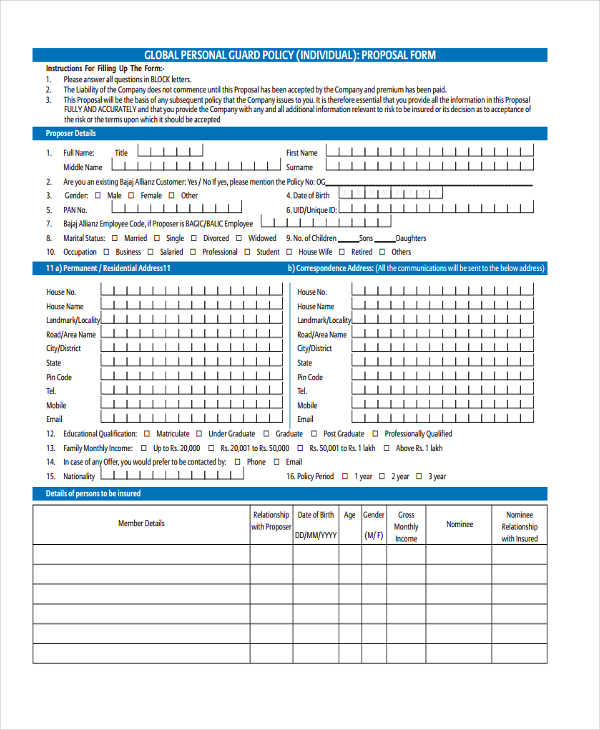

Free 11 Loan Proposal Forms In Pdf Ms Word

Paying Off A Mortgage Early How To Do It And Pros Cons

Can A Retired Person On Social Security Get A Mortgage Gobankingrates

Mortgage And Refinance Loans For Seniors On Social Security

How To Buy A Home And Stay On Track For Retirement Ramsey

Mortgages At Age 60 And Over

Report On The Living Conditions Of Roma Households In Slovakia 2010 By United Nations Development Programme Issuu

Mortgages In Retirement What You Need To Know Massmutual

Retired Good Luck Getting A Mortgage Even If You Re Wealthy Kiplinger

Get A Mortgage After Retirement How To Qualify 2023

Homes Land Of The Smokies Vol 36 Issue 8 By Homes Land Of Tennessee Issuu

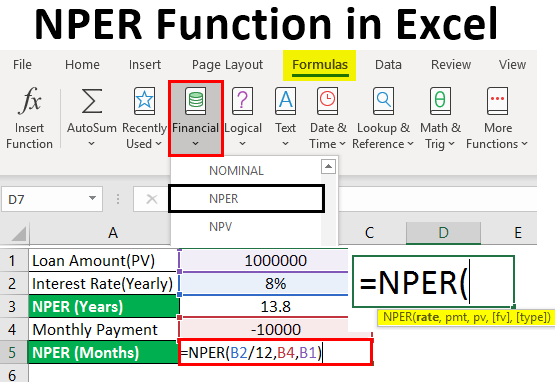

Nper Function In Excel How To Use Nper Function In Excel

Mortgages At Age 60 And Over

Mortgages For Seniors Everything You Need To Know Mortgages And Advice U S News

Port Washington News 1 11 23 Edition Is Published Weekly By Anton Media Group By Anton Community Newspapers Issuu

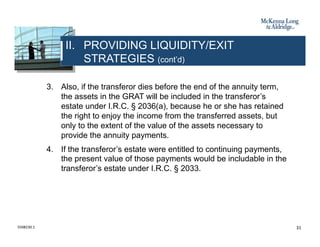

Business Succession Planning And Exit Strategies For The Closely Held